We Serve Clients Nationwide

Flat Fee, Fee Only, Fiduciary Advisors with Over 60 Years of Combined Financial Experience

The Flat Fee, Fee Only Advantage for Investors

At Clarity Capital Advisors, we are fiduciary financial advisors. Our flat fee pricing structure is in line with other medical, legal, and tax professionals - one simple and straightforward fee. We believe investors should pay a financial advisor a fair flat fee based on the advisor's education, professional designations (e.g., Certified Financial Planner CFP® and Chartered Financial Analyst CFA®), financial experience, and the services they provide such as financial planning (e.g., retirement planning, investment planning, retirement income strategies, charitable giving, college planning, income tax planning, etc.) and investment management. Fee only means no sales commissions, no surrender charges, no hidden fees, no revenue-sharing, and no kickbacks to investment providers. Our form of compensation provides total fee transparency and is aligned with the Fiduciary Standard for financial advisors.

Why do some financial advisors charge an asset-based fee such as 1%?

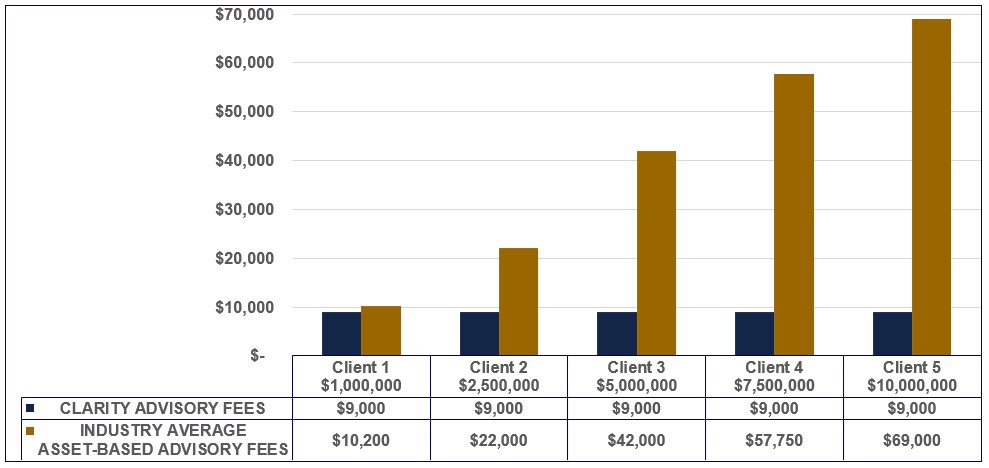

This fee structure is commonly referred to as an assets under management (AUM) fee. To many investors, a 1% fee sounds trivial especially when the stock market is up. How much is a 1% fee when we convert it to dollars? A client with $1 million in assets will pay $10,000 per year. At $2 million, the fee doubles to $20,000, $3 million is $30,000, and so on. The more you make, the more they take year after year! Some investors don't take the time to review their statements for fees or ask their advisor to calculate the dollar amount they pay for their services. We've seen advisors charge as much as 2% per year!

Always do the math! Quick calculation:

Your assets multiplied by .01 = Your advisory fee based on 1%.

Our $9,000 annual flat fee includes asset management and retirement planning.

Clarity's annual advisory fee of $9,000 is billed in arrears at $2,250 per quarter to your designated investment account(s). Please note that corporate retirement plans such as a company 401(k) or cash balance plan may pay more than $9,000 annually.

Client accounts are held with Charles Schwab & Co., Inc.

We do not have a required asset minimum.

Where does your current advisor's annual fee rank on this chart?

If you don't know, you owe it to yourself to find out.

The annual asset-based fees used in the chart and calculations below are from the AdvisoryHQ study, "Average Financial Advisor Fees and Costs 2023 Report."

Invest wisely!

Anyone can call themselves a Financial Advisor and give you advice.

Chartered Financial Analyst CFA® and Certified Financial Planner CFP® are the two primary designations for financial professionals.

Anyone can pass a securities exam and call themselves a "Financial Advisor" or a "Financial Planner". You wouldn't go to a physician who didn't have the appropriate education and credentials, would you? Then why would you place your financial assets (i.e., your retirement savings) with someone, a salesperson, who didn't take the time to complete advanced designations related to asset management and financial planning? Ideally, you wouldn't. Unfortunately for investors, there are many talented "salespeople" out there making empty promises and baseless market predictions who won't be able to provide you with the professional financial guidance and investment recommendations offered by a credentialed, fiduciary wealth advisor. Meet our Credentialed Fiduciary Wealth Advisors

The Fee-Based Advisor: Don't get caught in this very expensive trap!

Many financial advisors are "fee-based" advisors, dually registered with a registered investment adviser firm and a broker-dealer. This means they are able to collect a 1% AUM advisory fee as a registered investment adviser and accept sales commissions and hidden fees embedded in the investment products they may sell to you through their broker-dealer. Look for hidden sales commissions and fees in some annuities, mutual funds, and non-publicly traded real estate investment trusts. Fee-based advisors have an incentive to sell these products to you as sales commissions can easily add an additional 2 - 8% to the advisor's compensation, in addition to ongoing revenue from advisory fees. To avoid this conflict of interest, work with a "fee-only" fiduciary advisor. Fee-only, fiduciary advisors do not recommend investments with sales commissions or hidden fees. Their only form of compensation is the advisory fee they collect from their clients for their asset management and financial planning services. Clarity Capital Advisors is a fee-only, fiduciary registered investment adviser firm.

LEARN ABOUT OUR CUSTOMIZED, DIVERSIFIED INVESTMENT PORTFOLIOS

FACT: High advisor fees counteract the use of low-cost investments

We see financial advisors touting low-cost exchange traded funds (ETFs) and mutual funds or a low-cost investment strategy while charging their clients 1% or a tiered percentage asset-based fee. This defeats the purpose of a low-cost investment strategy! With historically high market valuations and low interest rates contributing to lower future investment returns, wise investors do all they can to control investing costs. One of the easiest ways to do this is to avoid using a financial advisor who charges you an annual advisory fee based on a percentage of the assets you place with them to manage. The good news is that you now have a viable alternative to high-cost advisors that requires no sacrifice in the level of service received, Clarity Capital Advisors.